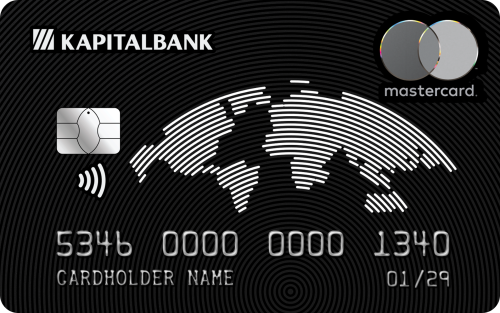

Issue:

50 000 UZS

Cash withdrawal at the cash department of the JSCB Kapitalbank:

0%

Transaction processing:

0%

Card account maintenance:

Free

Last modified date: 09/26/2025

Questions-answers

1.

How to secure a card?

Updated 27 June 2025 г. 18:33

Do not give your card to strangers, do not share the PIN code, and do not store it with the card. Do not leave the card unattended and do not provide the card details over the phone.

... I find the answer useful

2.

What is the validity period of a card?

Updated 27 June 2025 г. 18:32

A card is valid for 5 years. The validity period of the cards is indicated on the card itself.

... I find the answer useful

3.

Is it possible to apply for a card for a child?

Updated 27 June 2025 г. 18:32

Yes, you can apply for a card for children from the age of 14, but for children younger than that, the consent of his/her parents or guardians will be required.

... I find the answer useful

4.

What should be done if the card is stolen or lost?

Updated 27 June 2025 г. 18:31

In case of loss or theft of the card, it is necessary to contact the bank as soon as possible through the 1340 hot-line, block it through the Kapitalbank JSCB mobile application, or visit the nearest branch to block the card and prevent unauthorized use.

... I find the answer useful

5.

What documents are required to apply for a card?

Updated 27 June 2025 г. 18:31

The following documents are required for residents of the Republic of Uzbekistan:

- An identity document (biometric passport, ID card, new style driving license)

- Local operator's phone number

- International passport

- Registration in the territory of the Republic of Uzbekistan (if without QR-code, stamp of entry into the Republic of Uzbekistan)

- Individual Personal Identification Number

- Mobile number of an Uzbek national operator (+998)

- Non-resident client questionnaire filled in by hand

... I find the answer useful

6.

How to apply for a card?

Updated 16 July 2025 г. 19:00

The card can be issued via a one-time order in the mobile application, as well as at the Bank's branches

... I find the answer useful

7.

Is it possible to reissue a card before the expiration date?

Updated 27 June 2025 г. 18:33

Yes, the card can be reissued before the expiration date. For a month, in the same month and a month later - absolutely free of charge.

... I find the answer useful

8.

Which card to choose for international travel or shopping?

Updated 27 June 2025 г. 18:31

For international travel or shopping, Visa or MasterCard cards, which are accepted everywhere, will be the best option. These cards provide access to funds in foreign currency and allow to withdraw cash from ATMs abroad

... I find the answer useful